Why Portfolio Diversification Matters and the Role Real Estate Plays

Have you ever asked yourself- “Why does an investor need to diversify her portfolio?”. You may know the answer to the question if you were invested in internet stocks in 1999, or in real estate and bank stocks in 2007, or in travel and entertainment industry stocks at the beginning of this year. When the pandemic hit the economy earlier this year, it caused a market-wide decline in stock prices, but industries such as airlines (Delta, United, American), cruise ship (Carnival, Royal Caribbean), hotel (Hyatt, Hilton), and entertainment (Disney, Las Vegas Sands) were hit much harder. Being heavily invested in an asset or sector increases the risk of an investor’s portfolio without increasing the expected return. When a retail investor thinks of optimizing her portfolio, they need to consider two aspects: 1) Diversification of portfolio among different asset classes such as stocks, bonds, and real estate 2) Diversification of portfolio invested in a particular asset class. This article will briefly cover both aspects. Following that, this article will also highlight the importance of real estate in an investor’s portfolio and how much of an investor’s portfolio should be invested in real estate.

So why do we need to diversify our portfolio among different asset classes? Because as an investor we aim to earn the highest risk premium per unit of risk we take (defined as Sharpe ratio). Risk premium is the excess return over risk-free rate that an asset provides and risk is defined as the standard deviation of expected return. We expect the risk premium to follow this order:

Risk premium treasury bonds < Risk premium corporate bonds, and Risk premiumstocks

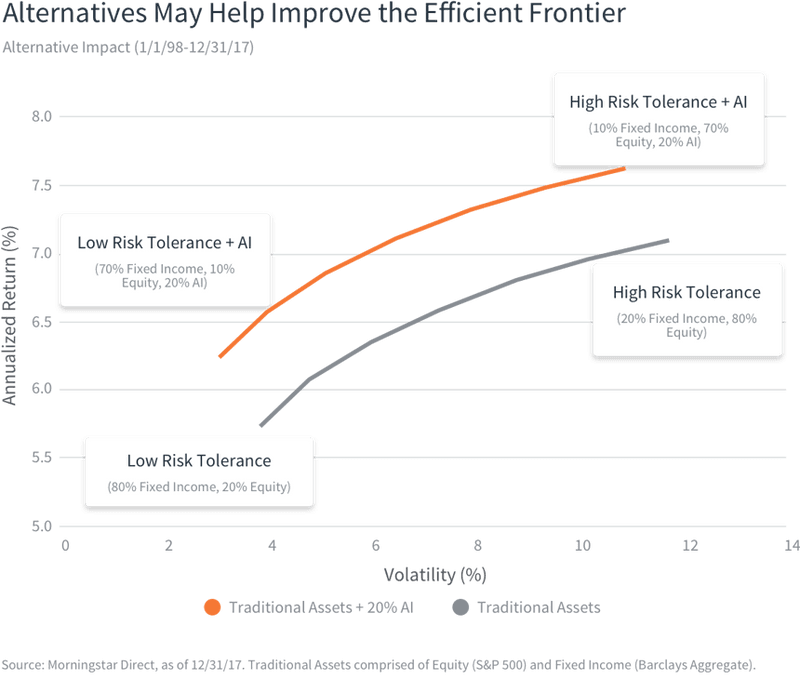

Based on this order, an investor with high risk appetite will prefer to put higher proportion of her money in stocks compared to an investor with a low risk-appetite. Portfolio diversification helps in increasing Sharpe ratio, no matter what the risk-appetite of an investor is. Returns from different asset classes are not perfectly correlated, and as long as the correlation between returns of two asset classes is less than 1, investor benefit from diversifying their portfolio among assets. As depicted in Figure 1, adding alternative investments to a portfolio of bonds and stocks increases the expected return for any given level of volatility (risk). So, an investor benefits from diversifying their portfolio among different asset classes such as stocks, bonds, and real estate.

When investing in a particular asset class, one needs to again consider diversification within the asset class. Any asset has two components of risk: Systematic risk and idiosyncratic risk. Systematic risk or market risk is defined as the risk due to events that impact broad market9 returns and investors cannot diversify away systematic risk. Idiosyncratic risk or unsystematic risk results from firm-specific events that impact a small set of firms. For example, firms in travel and entertainment industry were negatively affected by the pandemic. On the other hand, firms in technology and ecommerce sector such as Amazon and Zoom video communications benefited from pandemic. Having a mix of both types of firms would have resulted in diversifying away the idiosyncratic risk associated with individual firms/sectors. This would have also resulted in a higher Sharpe ratio for the investor’s portfolio.

Why real estate?

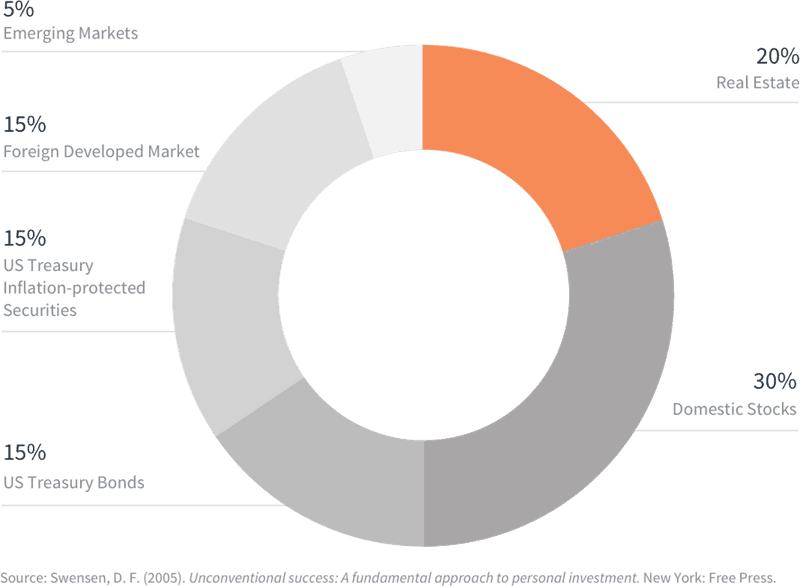

When we talk to a retail investor about investing, the most common answer happens to be investment in stocks. Investors tend to not know about other important asset classes such as bonds and real estate. Many investors are able to get exposure to bond markets through their retirement account. Unless an individual owns the house or condo they live in, being exposed to real estate market is not very likely. All homes in the US alone were worth $31.8 trillion dollar (Fortune (2017), in comparison, the value of all US stocks in 2017 was $27.4 trillion according to SIFMA Fact book. This clearly highlights the size of this asset class and the need for investors to invest some amount of their portfolio in real estate. David Swensen who manages Yale Endowment portfolio, suggests to allocate 20% of an individual’s portfolio in real estate (Refer to Figure 2).

How to invest in real estate

It is understandable that it is not feasible for most retail investors to buy a real estate property as an investment. This is especially true when they are investing only 20% of their total portfolio in real estate. Even with mortgage, investors still need to put down 10-20% of the price as down payment. Fortunately, there are many ways to invest in real estate that do not require you to buy a physical property. One can invest in real estate stocks, most of which operate as Real Estate Investment Trusts (REITs). REIT is a company that owns and/or manages a collection or real estate properties. Unlike stocks, REITs have an obligation to distribute 90 percent of their income in the form of dividends. Although there are some Residential REITs that invest in multi-family rental apartment buildings, REITs mostly focus on commercial properties. Residential real estate tends to be less sensitive to economy as people always have a need for a place to live. Recently, some start-ups (Fundrise in US and BuyProperly in Canada) have made it possible to for investors to buy fractional shares of real estate properties. One advantage of buying through these new fractional investing start-ups is that some of them, such as BuyProperly, allow you to buy residential properties. A study by D’Lima and Schultz (2020) finds that individual investors outperform major real estate indices. Real estate investors earn higher returns if they live close to the property they buy for investment, buy without a mortgage, and have experience investing in real estate. So, it might be beneficial for investors to pick a property of their choice and buy a slice of it using fractional real-estate investment platforms.

In summary, there is no guarantee which investment asset will give you higher returns: Real estate, stocks, or some other asset. Adding real estate in your portfolio is key to the principle of portfolio diversification. All rational investors want to maximize their returns for a given level of risk, and adding real estate to your portfolio will help you in achieving that goal.

References:

D’Lima W. and P. Schultz, 2020, Residential Real Estate Investments and Investor Characteristics, Forthcoming in Journal of Real Estate Finance and Economics.

Fortune (2017). Article available at http://fortune.com/2017/12/28/house-value-gain-zillow/

Guest post by Chinmay Jain