Are Canadians Moving to Secondary Cities? Should Toronto be worried?

There’s a reason why people move to cities. Cities provide job prospects, wage gains, and innovation. More than 80% of Canadians live in cities. And more than one-third live in the Toronto, Montreal, and Vancouver census metropolitan areas. Covid has accelerated the trend of people moving out of cities. Is it here to stay?

Secondary Cities Pre-Pandemic

Even before the pandemic, urbanites were slowly gravitating away from city hubs. Millennials were getting priced out of traditional powerhouse markets like Toronto, so they looked to more affordable options.

They were looking at places like Hamilton and Niagara. Both cities are commutable to Toronto’s downtown core, making them an attractive option for Torontonians. Hamilton experienced almost a 9% year over year price increase in a one-bedroom apartment in July 2019 whereas Niagara experienced a 15% year over year increase in residential home sales activity in October 2019. While there was growth in Hamilton and Niagara before covid, will the pandemic accelerate this trend?

Smaller cities and the pandemic

According to a survey conducted by Leger on behalf of RE/MAX Canada in 2020, 32% of Canadians no longer want to live in large urban centres. With remote work becoming the norm, Gen Y’s (29-39 year olds) are beginning to prioritize space over the city lifestyle. And young professionals are heading back to the suburbs with mom and dad, where they can save money. This departure of both young and experienced professionals is reflected in listing viewership and rental prices.

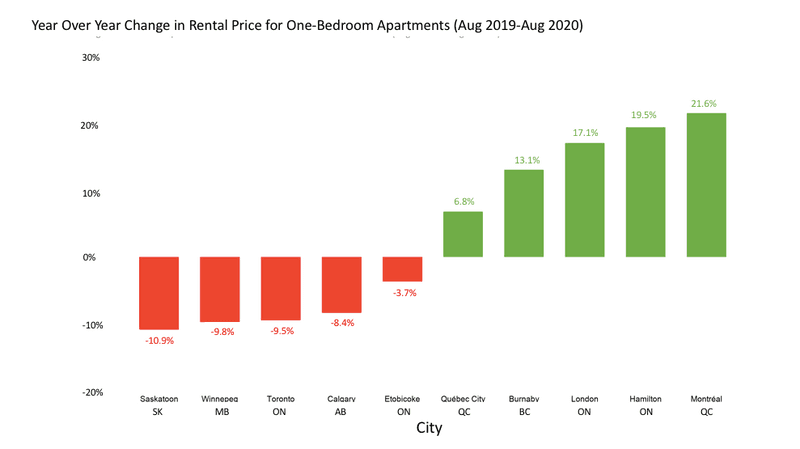

There was a 9.5% decrease in the average rental price for a one-bedroom apartment in Toronto from August 2019 to August 2020. Other large cities have seen similar declines, with the only exception being Montreal. This is because the city is having an influx of new condo listings in their prime downtown location and fewer listings in less expensive neighbourhoods.

While Toronto saw a decrease in rental prices, where does this leave places like Hamilton and Niagara? In Hamilton, rents have increased by 19.5% from August 2019 to August 2020 and all condo sales (one, two, and three-bedroom) increased by 10% from September 2019 to September 2020. The Niagara region saw one-bedroom rental rates increase by 14% from June 2019 to June 2020 and house sales increase by 38% from July 2019 to July 2020.

*data obtained from rentals.ca August 2020 National Rental Report

Should Toronto be worried?

While Hamilton and Niagara have a bright future ahead of them, is there going to be a decline in Toronto? We believe the answer is no.

During the 2008 housing crash, it took three months for Toronto to reverse from a decline in housing prices. At the beginning of 2009, the market saw a high volume of sales. Over time, the market did correct itself. Similar to the 2008 crash, we believe the market will eventually correct itself from the covid decline.

In fact, people are still moving to Toronto. Thanks to the lure of potentially high wages for highly skilled workers, recent post-secondary graduates see the city as a great place to move to. For every millennial who leaves Toronto, the city gains seven new residents. Not only are educated millennials making the move, but Toronto is also Canada’s immigration hub. In 2019, the city welcomed more than 100,000 immigrants – making it the Canadian city that welcomed the most immigrants. While the pandemic recently slowed the influx of immigrants, Toronto is still expected to see growth in immigration post-pandemic. Sure, it may seem like Toronto is losing appeal to long-term residents, but recent grads and immigrants will keep the city alive and well.

The Bottom Line

The question of how Toronto will grow alongside secondary cities, only time will tell. But for those folks who can think long-term and look beyond fear, there will be buying opportunities, both in major centers and secondary cities.

That’s why we chose to invest in Hamilton – we recently acquired a newly renovated detached home in Hamilton for below asking. If you’d like to invest in our Hamilton property for as little as $2,500, learn how on our website.