Is the Toronto Real Estate market set to crash in 2019?

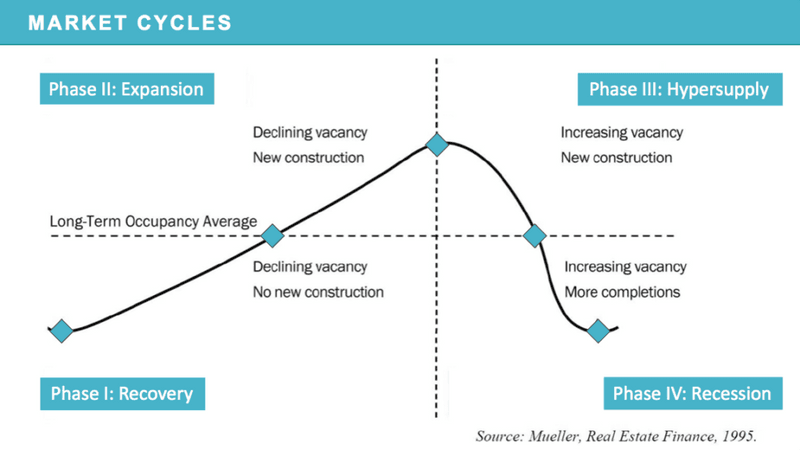

Real estate markets work in a cycle and has pretty much been on schedule in the past 100 years outside of circumstances such as the Great Depression and World War. The median cycle has been 18 years long. It was first observed by Henry George. He broke the cycle down into four phases – recovery, expansion, hyper-supply, and recession.

Chart 1: Real Estate Cycle

Source: Mueller, Real Estate Finance

Phase One: Recovery

Most of us are familiar with what a recession looks like- we had one in 2008. High unemployment, decreased consumption, decrease in investments of all kinds- business, buildings. Phase one is the first phase after a recession. It is a new beginning but given this is the time right after a recession, people are risk averse, activity is low, unemployment is still high, and housing starts / new construction is low. If we look at this data for US you will notice that the situation looks like follows. Government intervention is often driving this new growth through lower interest rates, and other incentives to grow. This was the case for US in 20010-11. Vacancies that were the highest around 2008, beginning to reduce, which in turns means rents start to go up and housing prices start to go up as well, as the only inventory is that from previous constructions.

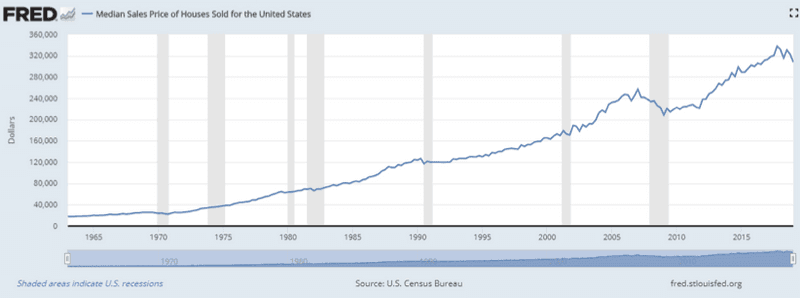

Chart 2: US Median House Prices

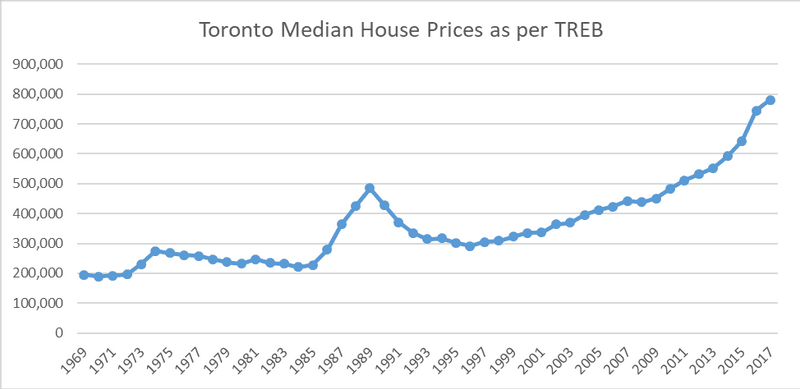

In Toronto, this was the situation around 1995-97. This is when prices pretty much just recovered the losses after the 1989 peak. This is also when well capitalized developers begin looking for huge areas of land. For example, Concord Pacific bought the Toronto land used for City Place in 1996.

Chart 3: Toronto Median House Prices

Phase Two: Expansion

Phase two is the expansion phase. In this phase, we will see occupancy begins to increase and exceed long term average, vacancy across residential and commercial starts reducing. With vacancies going down, rents start going up. Double digit rental growth in some markets right now. Besides seeing a growth in the building permits and housing starts one of the clearest signs of the expansion phase is the hyper growth of rents.

And since most real estate expenses are fixed, every increase in rent leads to increase in profits. With increased profits, it will attract more builders and more building activity.

New construction starts to pick up, unemployment begins to decline, and generally the economy is humming along. New opportunity brings in more immigration, and the cheap real estate/good business environment is perfect for creating a lot of jobs.

The laws of supply and demand will eventually catch up and curb the rise in profits, but in real estate everything takes time. Building a new home or office or apartment takes time to build and actually bring it to the market. Before building, deals have to be negotiated, studies conducted, permits obtained and financing secured. Interestingly, banks are more willing to finance and have less strict rules during expansion than recovery, which means this phase will see more financing and hence actual project implementation.

So what that means is by the time a meaningful amount of new inventory of houses come to the market and become available the overall economic expansion will have been well on its way for a good five to seven years. So, what that means is during that time demand has been able to far outpace supply and we’re starting to see that now which is going to lead to even higher occupancies and more and more increases in rents.

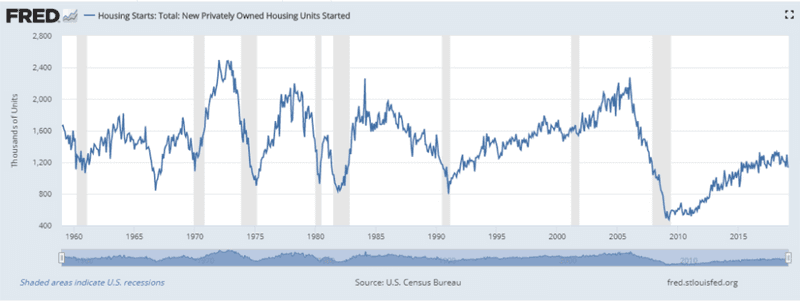

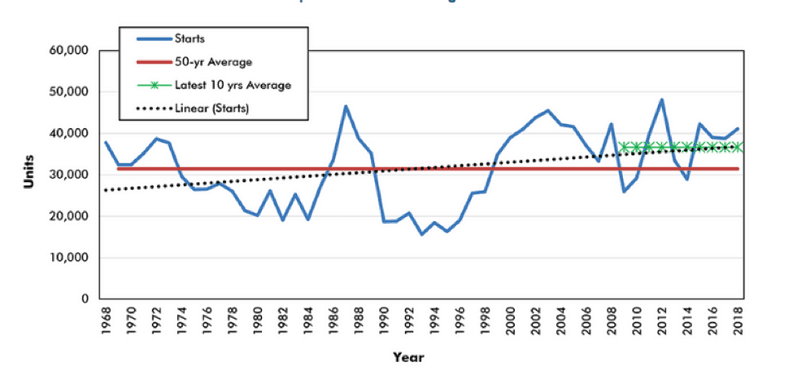

In US, housing starts have still not warmed up to their peak levels and so US is well within this phase.

Chart 4: US Housing Starts

In Toronto, this phase started around 2015-16 in my opinion and is ready to transition to the next phase.

Chart 5: Toronto Housing Starts

Source: BuyProperly Analysis, CMHC rental market report data

Phase Three: Hyper Supply

As long as there’s upward pressure on rents new construction is going to look financially attractive and more money will start to pour into the market.

More and more will want to own real estate and more money is going to pour into the market and not just for building new units but also for bidding up the price of existing inventory.

Best indicator of hyper supply stage is an increase in the unsold inventory or the vacancy.

This happens when new completions from the mid and late expansion phase start to saturate the market with a glut of new inventory that’s far more than what the market could actually support.

Okay so what we’re looking at here is the vacancy rates for single unit rental properties according.

This is the clearest sign of a shift in the market when rental growth decelerates.

So, if investors pay attention to this and begin to factor the consequences of the upcoming inventory and choose to stop building and building into new investments it might soften the correction. But this practically never happens because in a frenzy during a boom there’s always more money pouring into new projects until it’s too late and the market then crashes, and we enter a recession.

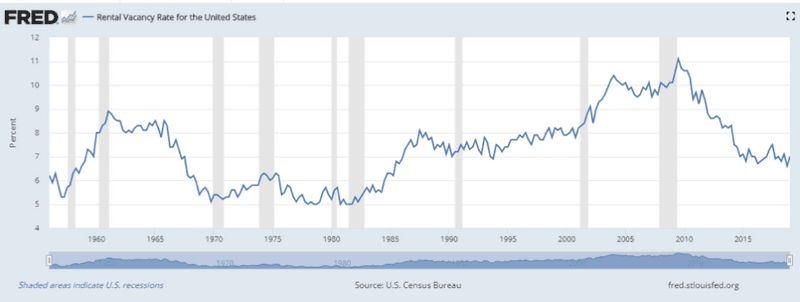

Rental Vacancy for US looks like the following and shows it has not yet had an upward trend and has some room for accommodating more property builds.

Chart 6: US Rental Vacancy Rates

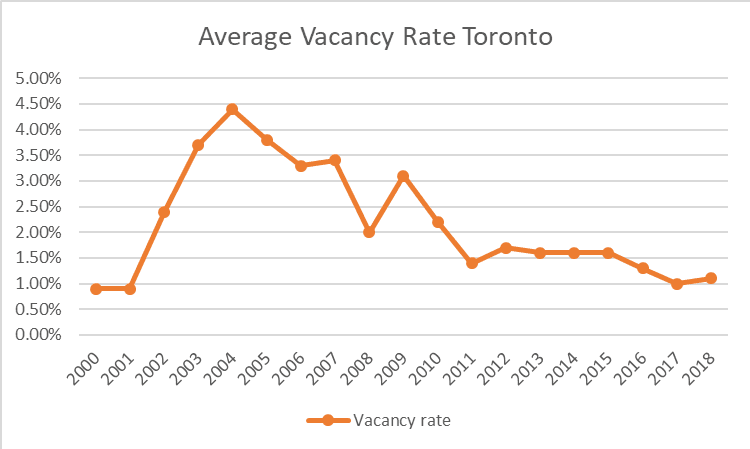

In Toronto, vacancy rates are at an all-time low of 1.1%, but are holding steady or looking to turn. With nearly 30,000 condos coming on to the market in 2019 and 2020, this should go up. Thus, Toronto is poised to enter the Hyper Supply phase, although it would be a few years before it hits the hyper supply peak as there is still room for demand to be absorbed.

Chart 7: Toronto Rental Vacancy Rates

Source: BuyProperly Analysis, CMHC rental market report data

Phase Four: Recession

The first sign of major trouble is the deceleration of rental growth. Now by the time the rental growth is at zero or even negative the next phase which is the recession phase will come soon.

Here the transition from the hyper supply the boom cycle to the recession occurs when occupancy rates start going down.

The long term averages the glut of new supply finally overpowers the market driving rents and property prices down and vacancies start to climb up and new construction stops, and the few new projects are going to start.

But the many projects that started in the hyper supply phase are still going to be continuing to be delivered. The continued addition of inventory leads to lower occupancy and lower rents which reduces revenue for the property owners.

Based on the economist's analyses and if the real estate cycle is going to follow its schedule of approximately 18-year cycle length, we should see US hit the peak around, 2024, and the downward cycle to start around 2026and ultimate bottom around 2030-31

In Toronto, the cycle is a little skewed given the inflow of immigrant population that has kept the demand for housing crazy.

The actual cycle can vary based on not just country, but city, or metropolitan area, hence Toronto would end up having a different cycle than Missisauga or Ajax for example, though with slight variations only as the overall macroeconomic factors, such as bank rates apply to all of them. We at BuyProperly constantly analyze neighborhoods, cities and regions, to ensure we are tracking their cycle. Reach out to us for detailed reports on this at [email protected]