Is Real Estate Inflation Proof?

There’s no doubt that real estate is a great investment. Over time, it has proved to be one of the most stable and reliable ways to grow your wealth. But is real estate immune to inflation? And if not, what can you do to protect yourself against rising costs?

In this article, we’ll explore the relationship between real estate and inflation, and give you some tips on how to stay ahead of the curve.

What is inflation?

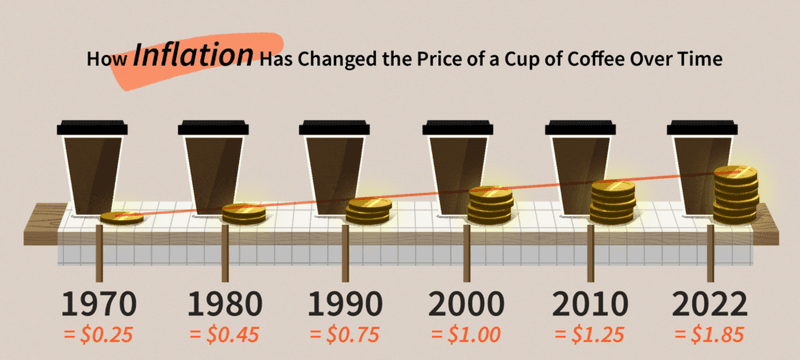

Inflation is defined as a sustained increase in the prices of goods and services. It’s usually measured by the Consumer Price Index (CPI), which tracks the cost of a basket of everyday items. When inflation is high, your money doesn’t go as far as it used to. You might not notice it at first, but over time, the prices of things start to creep up.

Why are we currently seeing inflation?

There are a number of reasons why inflation is on the rise. One of the main drivers is the global pandemic in 2020. The shortage of goods and materials and the increased demand for them have led to inflationary pressures.

Additionally, central banks around the world have been pumping money into the economy through quantitative easing (QE) programs. This is often referred to as “printing money,” and it can lead to inflationary pressures similar to what we’re seeing now.

How does inflation affect real estate?

Inflation affects real estate in two ways: home prices and mortgage rates.

When inflation is high, home prices tend to rise as well. This is because demand for housing is usually high when there is economic growth, and prices go up when there aren’t enough homes to meet that demand. Mortgage rates also tend to rise during periods of inflation, because lenders are looking to protect themselves from the potential for higher prices down the road.

Inflation can have a number of different effects on real estate. One of the most direct is on real estate prices. When inflation is high, prices for both commercial and residential real estate tend to increase. This is because as the cost of goods and services goes up, so does the cost of land and buildings.

In addition to prices, inflation can also affect real estate buying behavior. When inflation is low, buyers are more likely to purchase real estate, since it’s a relatively safe investment. However, when inflation is high, buyers may be more hesitant to invest, since the value of their money is decreasing.

Despite these effects, real estate is still considered a relatively safe investment during periods of inflation becauseit’s a physical asset that can’t be devalued by inflationary pressures. Additionally, real estate tends to appreciate over time, which can help offset the effects of inflation.

What does this mean for investors?

If you’re thinking of buying a home, it’s important to be aware of how inflation might affect your purchase. You’ll need to budget not only for the purchase price of the home but also for the higher mortgage payments that come with inflation. And if you’re already a homeowner, you’ll need to be prepared for your property taxes and insurance premiums to go up as well.

Is real estate a safe investment during inflation?

Real estate is generally considered to be a safe investment during periods of inflation. This is because home prices tend to rise along with inflation. Since real estate is a physical asset, it’s not as susceptible to the volatility that can occur in the stock market.

However, there are some risks to consider. If inflation is high, interest rates are likely to rise as well. This means that your mortgage payments will go up, even if your home’s value doesn’t increase. And if you’re carrying a lot of debt, rising interest rates can make it difficult to keep up with your payments.

Let’s look at the main reasons why real estate is a great investment during periods of marketing instability and inflation:

- It’s a physical asset: Real estate is a physical asset, which means it’s not as susceptible to the volatility that can occur in the stock market.

- It tends to appreciate in value: Over time, real estate has tended to appreciate in value, even during periods of inflation.

- It can provide a steady income stream: If you choose to rent out your property, you can generate a steady income stream that can help offset the effects of inflation.

- It can be a hedge against inflation: Since real estate tends to appreciate in value during periods of inflation, it can be a good way to protect your wealth from the effects of rising prices.

The bottom line is that real estate is a great investment during periods of inflation. It’s a physical asset that tends to appreciate in value, and it can provide a steady income stream. However, there are some risks to consider, such as the potential for higher mortgage payments and the difficulty of carrying debt in an inflationary environment. But overall, real estate is a safe investment during periods of market volatility and inflation.

So, is real estate inflation proof?

Yes and no! Here are some of the reasons real estate is not technically inflation-proof.

1. Home prices don’t always go up: While home prices have tended to appreciate over time, they don’t always go up. In fact, there have been periods of deflation (when prices fall) in the real estate market.

2. You still need to make mortgage payments: Even if home prices go up, you’ll still need to make mortgage payments. In an inflationary environment, these payments will likely become more expensive.

3. You could still lose money: If you need to sell your home in a hurry, you could end up selling it for less than you paid for it.

4. It’s not a liquid asset: Real estate is not a liquid asset, which means it can be difficult to sell quickly.

Despite these risks, real estate is still a great investment during periods of inflation. Just remember to consider the risks before investing, and to consult with a financial advisor to get the most accurate advice for your situation.

If you’re thinking of buying a home or investing in real estate, it’s important to do your research and understand how inflation might affect your purchase.

Make sure you budget not only for the purchase price of the home but also for the higher mortgage payments that come with inflation. And if you’re already a homeowner, be prepared for your property taxes and insurance premiums

How can you invest in real estate during periods of inflation?

If you’re thinking of investing in real estate, there are a few things to keep in mind. First, remember that real estate is a long-term investment. This means you’ll need to be prepared for periods of market volatility and inflation.

You can also consider investing in real estate securities, such as REITs, which are designed to provide investors with exposure to the real estate market without the hassle of owning and managing property.

Here at BuyProperly, we’ve helped hundreds of inventors get started in real estate for as little as $2500 by leveraging a fractional ownership model. Wondering how you can do the same? Click here to learn more.

Finally, make sure you do your research and understand how inflation might affect your investment. By being prepared and knowing what to expect, you can protect yourself from the most common pitfalls.

No matter what your real estate goals are, it’s important to be aware of how inflation can affect your plans. By being prepared and knowing what to expect, you can protect yourself from the most common pitfalls.

Conclusion

In conclusion, real estate is a great investment during periods of inflation because it’s a physical asset that tends to appreciate in value, and it can provide a steady income stream. Just remember to consider the risks before investing, and to consult with a financial advisor to get the most accurate advice for your situation.

If you’re ready to learn more about fractional investing and how you can get started for only $2500, click here.