COVID-19, here is how to protect your savings in a contagious market!

The world is in lock-down. Most businesses which cannot move online are in stand-by mode or have shutdown till further notice. Simultaneously, the stock market is in correction mode, with the broad S&P index having lost more than 27% of it’s value in the span of less than a month.

All as a result of a virus.

Here we dive deeper into why this virus is different from earlier episodes. Below is a comparison between different disease outbreaks and the S&P. The long run average to compare to is 4.5% annually, considering a 70 year post world war period.

Source: https://www.marketwatch.com/story/heres-how-the-stock-market-has-performed-during-past-viral-outbreaks-as-chinas-coronavirus-spreads-2020-01-22

According to the latest numbers (2 April 2020), Covid 19 has led to over 1,007,000 falling sick and over 52,000 deaths till now. In the same period, the stock market has declined significantly with the S&P 500 declining by ~27% from it’s all time high of ~3,400.There have been numerous previous disease scares and there seemed to be some correlation with the performance of the stock market, all depending on the severity of the disease and it’s impact in affecting consumption globally.

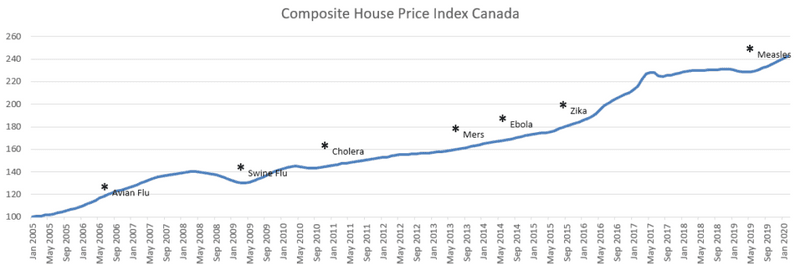

Below is a graph depicting the housing market composite prices for Canada over a 15 year period. There seems little direct correlation of a disease outbreak and subsequent impact on real-estate prices. Traditionally real-estate has been know to be an asset class with lower correlation to capital markets (e.g. stocks and bonds). Some of it can be attributed to stocks being a virtual ownership of a publicly-traded company whereas real-estate investment typically being associated with asset ownership and possession.

Source: https://www.crea.ca/housing-market-stats/mls-home-price-index/hpi-tool/

How could Covid-19 have a broader impact on the economy and consequently on stock and asset prices than earlier disease outbreaks?

Disrupting the supply chain: With the onset of the disease, crucial supply chains in China were disrupted immediately. The rise of the disease overlapped with the Chinese New Year meaning Chinese workers were unlikely to return to work in full capacity. This simply created supply side constraints in developed markets. Everything from consumer electronics to apparel to automotive was highly dependent on China and without supply, large companies, simply could not sell more.

Impacting consumption directly: A quarantine like situation meant at first Chinese consumption would suffer but in the broader context global consumption would decline. Customers – holed up in their homes from the disease are highly unlikely to consume as much as in a regular economic environment. Industries like Airlines, Hospitality and Oil & Gas were particularly impacted – with business dropping off immediately with an indefinite future.

Bringing an abrupt end to a prolonged business cycle: Many global stock market indices hit all time highs, with the S&P 500 peaking at the 3,400 range in February 2020. More than ten years of a bull run with share prices growing at roughly 15% every year – roughly 3 times of the 70-year average (1950 to 2020), closer to 4.5%. Low interest rates and cheap capital had helped foster a bull run where share prices had become disconnected from profit, or revenue – business fundamentals.

Deeper understanding by investors: In most cases institutional investors have in the past been less receptive towards diseases (including Zika and Ebola). While these big players drive volumes in the market and their bearish attitude could be an indicator of the scale of impact this virus could have. For the uninfected retail investor, it may be harder to see the concern with the same intensity as much as the well researched and globally connected institutional investors.

What is shaping this volatility in stock prices?

It is time of high market volatility. A major correction has already happened in stock prices and it could be a good time to get in, depending on your appetite for risk. A perpetually low interest regime means institutional investors have access to cheap capital and are constantly searching for higher returns.

This leads to projects or initiatives being undertaken which would typically not be initiated in a down time. This also means investing in speculative assets some of which may or may not have merit, e.g. blockchain firms and cannabis firms. The low interest rate environment also means high levels of corporate and household debt, as it is just easier to borrow. While all of this sounds good, it also creates a moral hazard for institutional investors – a bubble of sorts forcing investors to take on more and more risk to get the same returns.

A low interest rate regime should ideally bring the market back to a bull run soon after the bear run has ended. A lot of this would depend on other variables such as industry output, consumer sentiments and employment rate.

For the retail investor, it is a good time to plan ahead – reflect on your own financial prowess and appetite, conduct firm due-diligence (basically analyze before you invest) and diversify.

What can retail investors do at this stage?

First of all, at the time of writing of this article, these are extraordinary times with a bear market and diminished economic activity. From a personal perspective, the best asset at this moment is cash and cash equivalents like funds in high interest savings accounts (explore EQ Bank or Motive Financial in Canada or Marcus by Goldman in USA). This allows for significant capital preservation in bear markets. But in case you are already exposed to stocks and similar assets, the best advise is to analyze on a case by case basis and what your opinion of the broader environment is.

Below is a strategy for longer term wealth creation :-

Think closely where your net-worth is spread out, which asset classes and their risk profile. Also consider what your objectives are with capital appreciation, the time period you are looking at (e.g. 6 months vs 5 years) and your risk appetite (can stand big losses or prefer a steady ship). I would also recommend creating a short term buffer, a rainy day account that covers you if unexpected expenses arise.

After allocating your funds to rainy day and high interest savings account, start investing.

Traditionally retail investors would normally put their risk capital as follows – % of their age in bonds and the rest in stocks. So, for example as a 40 year old individual, you would have 40% in bonds and 60% in blue chip stocks. This distribution is flawed as it ignores other asset classes like commodities (e.g. gold), private markets (invest in a private company), real estate and other financial products like options and crypto-currency. While it is advisable to still invest your risk capital in primarily stocks and bonds (40% to 80%), in these uncertain times, low correlation yet tangible assets like gold, silver and real-estate could be explored.

For exposure to equities and bonds, Exchange Traded Funds (ETFs) are an ideal place to start as they allow you to track the market and minimize level of research you need to put into buying a share. There is also inherent diversification. An ideal way to start is to get a zero-fee account (e.g. Wealth Simple Trade or Questrade in Canada and Robin Hood in USA). Consider investing in tracker funds like the ones by Vanguard (list here – https://investor.vanguard.com/etf/list#/etf/asset-class/month-end-returns).

Be mindful of the fact that each asset class has its own characteristics. While keeping cash is safe and liquid, it does not allow you to benefit from the value creation of companies. Real estate seems steady but offers limited liquidity to the buyer, i.e. getting in and out is difficult and time consuming. Commodities like gold and silver are less correlated with the capital markets but often require specialized knowledge of what drives prices in those markets.

What diversification really provides, is exposure to a range of asset classes, many of which may not move together. For example, while your stock portfolio may decline, price of your home and savings in high interest savings account may continue to increase.

How can I get exposure to real estate without investing millions of dollars?

Buying shares in real estate stocks, or REITs is one way. Alternate investing companies like BuyProperly can provide you the resilient exposure that you need to properly diversify. With as little as $2,500, you can get direct exposure to the property market and own a small portion of a condominium or a home. Best of all the approach is tailored for passive investors who do not have the time to analyze every property before buying or to physically manage tenants.

As long as you are aware of the risks involved like low initial liquidity, potential returns and how such an investment matches your needs, it should work well.

-The views and opinions expressed in this article are entirely of the author.

-Gautam Siddharth