Bank of Canada’s Interest Rate Cuts: Impact on Investors

Bank of Canada’s Interest Rate Cuts and What It Means for Investors

The recent decision by the Bank of Canada to reduce the key interest rate by 25 basis points to 4.5% is significant for real estate investors. This rate cut aims to stimulate economic activity by making borrowing cheaper, which can lead to increased investment opportunities in residential housing developments, real estate investment trusts (REITs), and real estate crowdfunding platforms. At BuyProperly.ai, this reduction can enhance the attractiveness of fractional ownership investments, allowing investors to benefit from lower financing costs and potentially higher returns on their property investments.

Why Does the Bank of Canada Adjust Rates?

There are many factors that affect interest rates in Canada such as inflation, consumer spending, economic trends, employment levels and economic growth. These current economic conditions are what Bank of Canada uses to determine whether to increase, decrease or leave interest rates unchanged.

Inflation

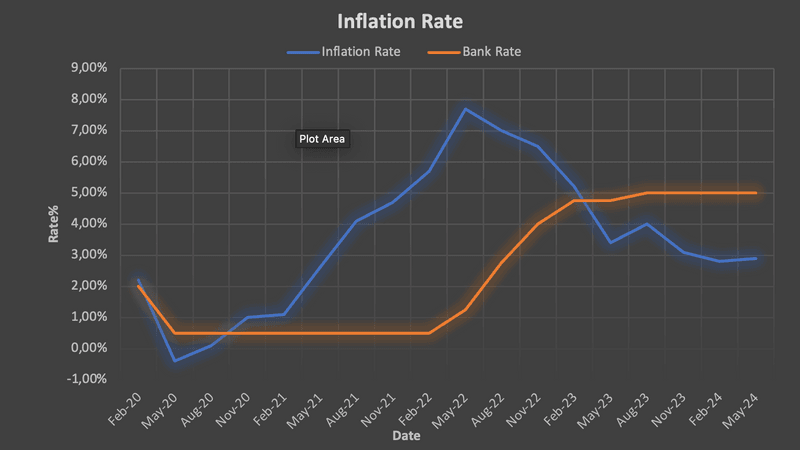

Interest rates were notably low during the COVID-19 pandemic to support economic recovery, but they have skyrocketed over the past two years due to rising inflation. Inflation during the COVID-19 pandemic was caused by a combination of factors, including supply chain disruptions, increased government spending, and shifts in consumer demand. Supply chain issues led to shortages of goods, driving up prices. Governments around the world injected significant amounts of money into their economies through stimulus packages to support individuals and businesses, increasing the money supply. Additionally, changes in consumer behavior, such as a surge in demand for certain products and services, further strained supply chains and contributed to price increases. These factors combined to create an inflationary environment as economies began to recover from the pandemic's initial impact.

With covid now under control, inflation has decreased significantly as supply chains have stabilized, consumer demand has normalized, and monetary policies have been adjusted to curb rising prices. Analyst now expect rate cuts to reflect the decrease in inflation since its peak of 8.1% in June 2022.

Economic Growth & Consumer Spending

Economic growth and consumer spending had slowed during the pandemic and although consumer spending is slowly getting back to pre-pandemic levels, our economic growth has not. This slow growth is another driving factor that can create rate cuts in order to stimulate the economy.

Employment

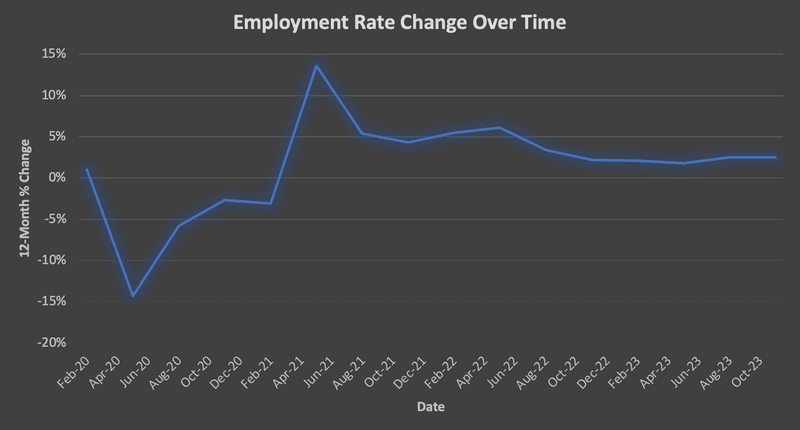

Although the unemployment rate has steadily been decreasing since its peak in 2020, it rose to 6.4% in June 2024 and has been trending up since April 2023, rising 1.3% during that period. Higher unemployment rates lead to rate cuts.

How Changes in Interest Rates Affect Real Estate Investments at BuyProperly.ca

Interest rate fluctuations have a direct impact on real estate investments, including those accessible through BuyProperly.ca. Here’s how these changes affect various investment opportunities such as residential housing developments, real estate investment trusts (REITs), and real estate crowdfunding platforms through fractional ownership:

Residential Housing Developments

Higher Interest Rates: When interest rates rise, borrowing costs for developers increase. This can lead to higher costs for project financing, potentially reducing profit margins. As a result, there might be slower development activities and fewer new projects.

Lower Interest Rates: Conversely, lower interest rates reduce borrowing costs, making it cheaper to finance new developments. This can spur more construction activity, leading to more investment opportunities and potentially higher returns for investors.

Real Estate Investment Trusts (REITs)

Higher Interest Rates: REITs often rely on borrowing to finance their property acquisitions. Higher interest rates increase their financing costs, which can reduce profitability and impact dividend payouts to investors. Additionally, higher rates might lower property values as borrowing becomes more expensive, affecting the REIT’s overall valuation.

Lower Interest Rates: Lower rates decrease the cost of borrowing, potentially enhancing the profitability of REITs. This can lead to higher dividends and potentially higher REIT valuations, making them more attractive to investors.

Real Estate Crowdfunding Platforms

Higher Interest Rates: Investors in crowdfunding platforms might face higher returns on other fixed-income investments, making real estate less attractive in comparison. Additionally, higher rates can increase the cost of financing projects listed on the platform, potentially reducing returns.

Lower Interest Rates: When rates are low, real estate becomes more attractive compared to other fixed-income investments. This can increase investor interest and participation in crowdfunding platforms, leading to more successful funding of projects and potentially higher returns for investors.

Fractional Ownership

Higher Interest Rates: The cost of financing fractional ownership shares increases with higher interest rates, which can lower the appeal of these investments. Investors might see lower returns due to increased expenses associated with higher borrowing costs.

Lower Interest Rates: Fractional ownership becomes more appealing as financing costs decrease, making it easier and more affordable for investors to acquire shares. This can lead to increased investment activity and higher potential returns.

Overall, changes in interest rates play a crucial role in shaping the landscape of real estate investments. At BuyProperly.ca, understanding these impacts helps investors make informed decisions, balancing the cost of borrowing with potential returns to optimize their investment strategies.

Comments

Your comment has been submitted