Unlock high-earning investment categories with BuyProperly

For the first time, everyday people can access valuable asset classes that have always been the ultra-wealthy's domain.

Access property investments that go far beyond the housing market. Our opportunities include residential housing developments, real estate investment trusts (REITs), and real estate crowdfunding platforms. Through fractional ownership, investors can own a "piece" of a given project - like a stock - allowing for a smaller upfront investment.

Private credit is an asset class that includes loans and debt investments that have been extended to non-publicly traded companies. These investments often come with higher yields compared to traditional fixed-income securities.

Through private equity, you can own part of a company that has not yet gone public. Your capital will create value by helping them grow and become more profitable. This type of investment has the potential to vastly outperform public companies if the startup takes off.

Venture capital involves investing in early-stage companies with high growth potential.By owning a piece of these promising companies, retail investors have the chance to earn larger returns from rapid growth.

Hedge funds are pools of money managed by financial experts. Unlike traditional investments, hedge funds allow you to benefit from professional fund managers' expertise and access more diverse investment strategies.

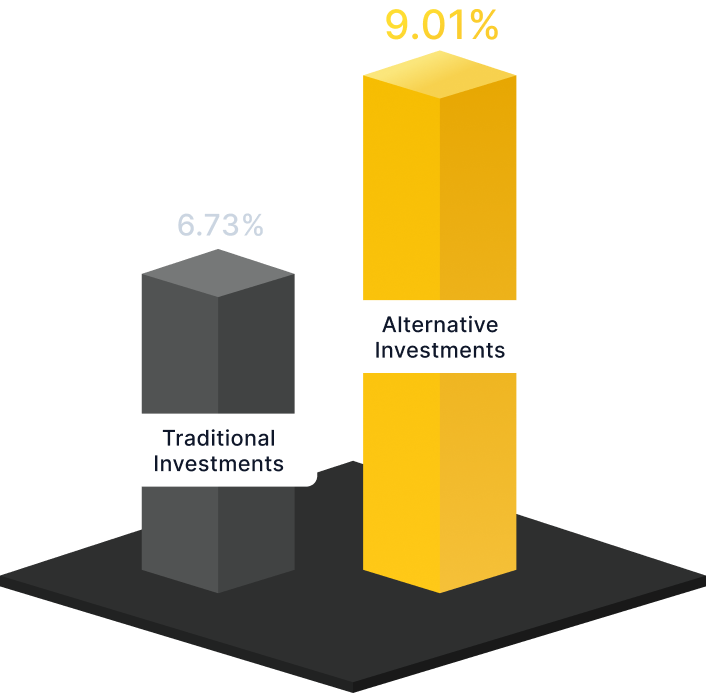

Diversifying your portfolio beyond stocks and bonds means your investments won't move in lockstep with traditional assets. By reducing correlation with the broader market, you can reduce your overall risk.

Investing in alternative asset classes offers exposure to different market segments. These alternatives often have unique risk-return profiles, and the inclusion of non-traditional assets reduces reliance on the performance of a single asset class.

Alternatives offer higher-yielding opportunities that are simply not available via traditional markets.They often involve active management strategies, allowing skilled fund managers to capitalize on market inefficiencies that earn you more than typical stocks and bonds.